Need SR-22 insurance assistance?

CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance CALL our licensed Agents

(Mon-Fri, 8am – 5pm PST) for personalized guidance

|

SR22 Texas Insurance

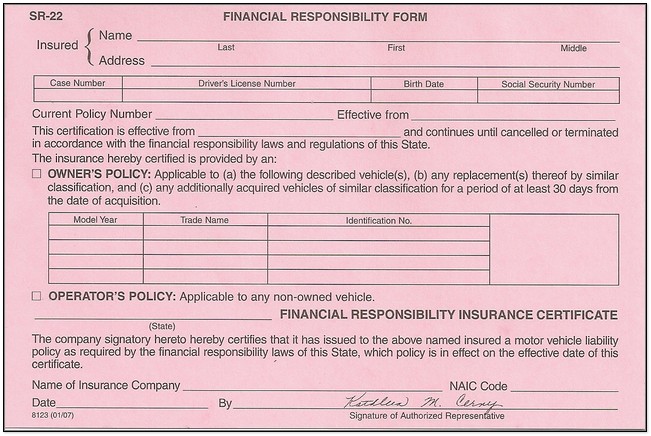

Riding behind the wheel can bring newfound freedom and responsibility, but also comes with risks. Many drivers don’t know what to do when an accident occurs. That’s where SR22 Texas insurance comes in. SR-22 insurance is a certification required by some states to prove that you have enough liability insurance. Without it, you may be unable to drive legally. This guide explains everything you need to know about Texas SR-22 insurance, so you can drive with confidence.

SR22 Texas Insurance is a type of financial responsibility coverage certificate for operating a vehicle. It is considered a type of insurance for those that are high risk due to past behaviors. There are specific laws that pertain to SR22 Texas Insurance, and you want to make sure you are in compliance.

Who is Required to have Texas SR-22 Insurance?

A person may be required by Texas law to obtain one in order to reinstate their driving privileges in the state. If an individual has been involved in a vehicle accident without vehicle insurance or convicted of a DUI or DWI, then they may be required to have one for up to 5 years. The minimum period of time is going to be a period of 2 years.

Buying SR-22 Insurance in Texas

When you’re searching for SR-22 insurance, know that it’s no different than other types of insurance. It’s simply designed to provide extra protection if you’re driving with a high-risk license. It also helps your insurance company contact your state to demonstrate that you have the coverage you need. Ultimately, it’s a way for states to ensure drivers meet the minimum accountability standards for insurance coverage.

Paying for SR-22 insurance is often slightly higher than regular insurance, but that’s usually as a result of the coverage you need. By law, SR-22 insurance companies are required to provide liability coverage. Liability car insurance can help protect you if you cause an accident that results in property damage to another person. The insurance company won’t pay for your damage, only the damage to the other person.

If you’re required to get SR-22 insurance in Texas, there are a few different avenues that can help you meet the requirements. First, consider talking to your insurance company. Most companies offer SR-22 forms and can help you determine the amount of coverage you need. Many insurance companies are also familiar with Texas state laws, so they can provide the SR-22 forms you need to stay legal.

As you shop for SR-22 insurance, remind yourself why you’re getting it in the first place. SR-22 insurance is a way to prove to the state that you’re following the law when it comes to insurance. You may be required to have it after an accident, or as a result of a DUI or DWI. In almost all cases, SR-22 insurance is mandatory for those who are in the high-risk category.

Another helpful resource for finding SR-22 insurance is to ask around and get recommendations from friends and family who may have gone through the same process. You can also check out reviews for different Texas insurance providers and compare prices. Make sure you read the fine print to determine the coverage you’ll need before signing an agreement.

Finding a Provider

Not all insurance providers offer SR22 bond so you may have to spend some time looking around on internet for the coverage. Here a typical provider of SR22 Texas insurances. Keep in mind that such coverage is considered to be high risk. Your current vehicle insurance provider may not be able to continue carrying you for that reason. Take your time to make sure you work with a reputable provider that has the right practices in place to be in compliance with Texas law.

Keep in mind that a regular insurance card isn’t going to be sufficient. The specific coverage has to be for the individual with this stipulation on their driver’s license and it has to cover a specific vehicle or specific vehicles that a person is driving.

What to Do

In Texas, the SR-22 insurance process is similar to other states. You’ll need to fill out an application and submit it to the state along with a fee. Make sure you have your driver’s license number and a copy of your insurance policy ready. Depending on your driver status, you may also need to submit an SR-22 filing for your insurance.

Once you have the right coverage, you’re a few steps away from legal driving. The best part is, once you’ve got the SR-22 insurance, you don’t have to worry about it until you need to renew; the requirements then are the same as when you initially applied.

Understanding the law is one of the most important parts of driving with confidence. Knowing about SR-22 insurance in Texas and what to do in case of accidents is key to recognizing and avoiding risky situations. If you have questions, make sure to consult your state’s website for the latest laws and regulations.

When it comes to finding the right SR-22 insurance, it’s easy once you know the basics. The first step is finding an insurance provider with a good reputation. Do your research to make sure they offer the coverage you need at a competitive price. Shopping around can also help you find the best option for SR-22 insurance in Texas.

Once you have coverage, you can begin to drive safely again, confident that you’re following all the laws and regulations of your state. Remember, being proactive is the best way to stay out of dangerous situations. Follow the rules, use common sense, and update your insurance policies on time. With the right insurance, you’ll overcome any risk the roads bring.

When researching Texas SR-22 insurance, make sure to check the details of each policy. You’ll want to read the fine print carefully to make sure your coverage meets all the requirements. Depending on your situation, you may need a different type of coverage such as collision, comprehensive, or uninsured motorist insurance, so make sure you get the right policy.

Don’t forget to factor in any discounts you may qualify for. Depending on the insurer and the coverage, you may be eligible for discounts based on your age, driving history, or type of vehicle. The good news is that getting the right policy doesn’t have to be expensive.

It’s important to know what you’re getting when you purchase an SR-22 policy. Make sure you know what you’re signing up for, and keep in mind that you must comply with all the state’s requirements. Look for customer reviews of any insurers you’re considering to make sure you’re getting the best service—it can make a huge difference in the outcome of your policy.

Many Texas drivers are confused by SR-22 insurance, but don’t be intimidated. Knowing what coverage you need and that you’re getting the best price can help you drive with confidence. Getting SR-22 insurance is a simple, straightforward process—so long as you have the right information.

When it comes to filing an SR-22 form in Texas, timing is crucial. So, if you’ve been in a car accident, it’s important to act quickly to secure the coverage you need as soon as possible. The state requires you to provide proof of coverage within 30 days of the accident. To make sure you’re covered, you can contact your insurance provider and they can help you file an SR-22 form right away.

If you’re not currently required to file an SR-22 form, you may be asked to do so if you’ve received certain traffic violations. The state of Texas mandates that all drivers must have sufficient insurance coverage, so make sure you’re aware of all the regulations.

The more educated you are about Texas SR-22 insurance, the better. There are plenty of great resources available that can provide helpful information. Make sure you check out the state website for complete information about SR-22 insurance, including what forms is require, fees, and the penalties associated with failing to carry the appropriate insurance coverage.

Carrying the appropriate insurance can often be the difference between staying safe and getting into an accident. Understanding all the requirements of SR-22 insurance ensures that you’ll be driving with increased confidence and peace of mind. Taking the time to understand your insurance policy is a crucial part of being a responsible driver, and ultimately, it could save you a lot of time, money, and stress.

When it comes to penalties, Texas is tough on those who don’t carry the right coverage. If you’re caught driving without any liability insurance, you could face serious penalties, such as license suspension or hefty fines. Don’t take the chance—make sure you understand the law and the right type of coverage you need.

At the end of the day, knowing what type of SR-22 insurance you need in Texas makes you a better, more responsible driver. With the right policy, you can tackle any road safely and confidently. The key is understanding the process and taking the time to shop around for a policy that best meets your needs.

Non Owner SR22 Insurance

For an individual that doesn’t own a vehicle,  borrowing from other people may be how they get around. When that is the case, there is a type of program available. It is referred to as the Texas Non Owner SR22 Insurance Policy. It will cover an individual driving vehicles owned by other individuals. Such coverage may be necessary for anyone that drives employer vehicles while on the job too.

borrowing from other people may be how they get around. When that is the case, there is a type of program available. It is referred to as the Texas Non Owner SR22 Insurance Policy. It will cover an individual driving vehicles owned by other individuals. Such coverage may be necessary for anyone that drives employer vehicles while on the job too.

Non owner SR22 insurance policies are in some cases misinterpreted by customers. Several believe that a non owner SR22 insurance policy will cover you for any car that you may possibly drive, which happens to be not real and can result in discovered accidents.

SR22 Texas Coverage

The state of Texas does require particular coverage amounts with SR-22 insurance. This includes:

- Bodily injury or death of a person in an accident of at least $30,000.

- Bodily injury or death of two or more persons in an accident of at least $60,000.

- Damage or destruction of property to others in an accident of at least $25,000.

SR22 Insurance Cost in Texas

Due to the higher risk involved with people that need to carry SR22 insurance in Texas, the cost is going to be much higher than your typical vehicle insurance premiums. The cost will vary though based on a variety of factors including:

- Age

- Driving record

- Reason SR-22 is required

- Length of time SR22 is required

- Type of vehicle covered

- Credit score

Shopping around for the best price is a good idea. Don’t assume that every provider is going to have the same premium for SR 22 insurance coverage. A vehicle that has a good safety rating is going to have a lower cost so it may be a good option to consider changing vehicles if you need to have such coverage to help you save money.

Reinstatement

Texas law requires that the individual has to pay a driver’s license reinstatement fee. They also have to show proof of the SR22 insurance coverage at the time that the reinstatement fee is paid. Only then will the person be able to obtain their Texas driver’s license. If the individual isn’t legally eligible to obtain their driver’s license in Texas for any reason then it won’t be issued.

Canceling SR22 Texas

If you cancel SR22 Texas insurance and it is still a requirement for your driving privileges, your Texas license will be revoked. The only exception is if you cancel it with one insurance company to obtain such coverage with another company. You must be very careful though with the dates of coverage so that there is no lapse. For example, if coverage is to end the last day of May with one provider, it is essential that the coverage with the new provider begins the first day of June.

The SR22 can be canceled by the customer or it can be canceled by the insurance company if the customer fails to make payment. If it is canceled then the insurance company will issue an SR-26 form to notify the Texas Department of Public Safety.

SR-22 Filing

An SR-22 Filing can be a form issued by an insurance company that eliminates a revocation order located from the Texas Office of Transportation’s by using an individual’s driving a car privilege. Many people often inquire if an individual may receive an SR-22 filing and steer clear of acquiring insurance. Actually this may not be achievable because an SR22 filing is evidence of liability insurance in force. The filing provides a assure on the Department of Motor Vehicles (D.M.V.) that this insurance business has released no less than minimum insurance for that individual generating that filing.

The SR-22 filing is submitted in electronic format to the Department of Motor Vehicle’s data source. When and if your policy cancels or lapses, the insurance plan service provider notifies the department of autos of your lapsed or cancelled status. The department of motor vehicles then concerns a revocation inside the driver’s permit.

Texas rules mandates that you continue your SR22 insurance plan for quite a while. When your insurance coverage is cancelled within that time period, legislation necessitates that your insurance company quickly notify the Department of Public Security so that it can suspend your driver’s permit yet again using the original revocation period of your phrase. It is actually vital that you resubmit a brand new SR-22 insurance Texas insurance for the DPS if you need your permit back again.

Excluded drivers

Under Texas law, insurance plan companies may possibly exclude a motorist from addition on the car insurance policy for legitimate reasons. When a vehicle driver is excluded from an insurance policy, he may have no liability insurance but he still need the accountability coverage if he drive each of his cars and obtain in a crash. Any exclusion is going to be placed in the part of your policy with all of other difficulties which relieve the insurance coverage company from paying out boasts.

When your license to drive is suspended or revoked you could get an insurance plans policy which includes the SR22 qualification to regenerate your permit. This is usually a problem because so many insurance plan organizations will not encourage you with a coverage if your license is just not reputable. Luckily some companies will issue a coverage for motorists by using a terminated or stopped driver’s license.

SR22 Bond

SR22 bond also known as a monetary obligation bond is one way for individuals to satisfy their state’s bare minimum insurance policy demands. The purpose of an SR22 bond is always to allow the car owner to keep their certificate and to safeguard other individuals.

An SR22 bond for auto insurance is simply a courtroom requested evidence of monetary duty. This is needed by Texas State to help keep or get back your driving a vehicle privileges.

A SR22 bond in Texas State will likely be essential for 36 months, but may be dependant upon the issues you’ve experienced with your license in the past.

Cheap SR22 Insurance Texas

Cheap SR22 insurance Texas coverage is simple to find should you just look around. Actually, the easiest was for the greatest SR22 insurance policies for you personally is always to assess quotations from several different companies as is possible. Individuals that need SR22 insurance plan are viewed heavy risk and can usually deal with better rates. There are some companies that actually are experts in offering SR-22 filings and might give much more sensible rates. That is why it is essential these drivers examine estimates from several companies as you possibly can. It’s easy to find extremely cheap sr22 insurance plan in San Antonio, Austin, Houston, Dallas and the other main metropolitan areas of Tx.

At some point individuals maintain paying great costs for SR-22 insurance policy just because they are too hectic or sluggish to truly make the energy.

About SR-22 Texas, last thing to say is that the SR22 insurance cost varies by motorist and by insurance policy company, so there is not one particular established value that every vehicle driver will pay. Look around by internet it’s your best option.